How to Find Someone’s Assets Online

Finding out what assets someone has can be important in many scenarios. Maybe you’re in a financial dispute, trying to settle a loved one’s estate after they’ve passed away, or simply curious about someone’s financial landscape. Legal battles can be costly and time-consuming, so before you head down that road, you might want to do some smart, budget-friendly searches to see if it’s worth the hassle.

This article will walk you through some simple and practical steps you can take to search for someone’s assets, from public records databases to third-party search platforms, all without spending a fortune.

Navigation Guide

1. Search publicly available sources

| Best when: You’ve got a few basic details about this person and want to do some casual online searches. |

Public records can offer a wealth of information about an individual’s assets, particularly real estate holdings, and business affiliations. In the US, these records are publicly accessible to promote transparency and combat fraud, making them a powerful tool for research. Here’s where to begin:

Before we continue: How to find public record entries for a specific state or county?

Many public records, like property deeds, court records, or tax assessments, can be found directly from official sources. And you have several ways to access them.

- Search directly

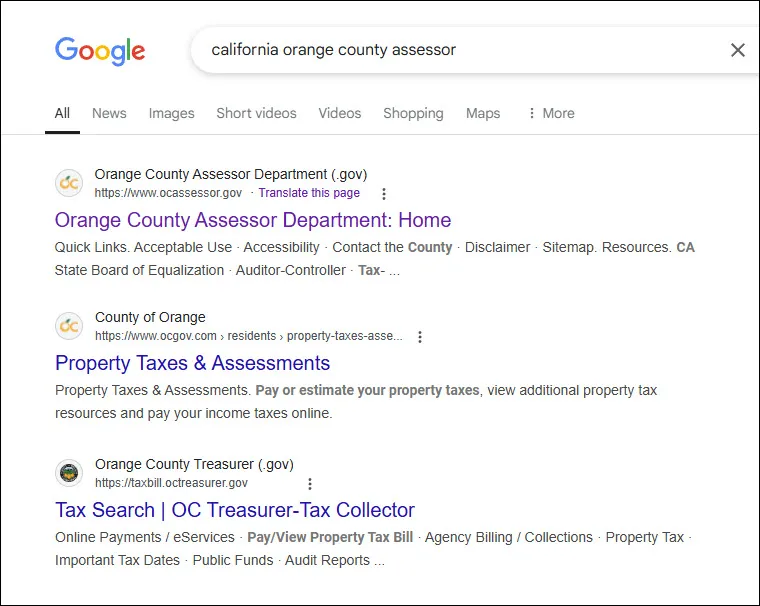

One simple way is to just use a search engine, like Google or Bing. For example, if you need property tax information from the county assessor’s office, just search for something like “California Orange County Assessor”. Look for websites ending in “.gov” or “.org”, as these are usually official government or non-profit sites. This direct search often takes you straight to the official county website.

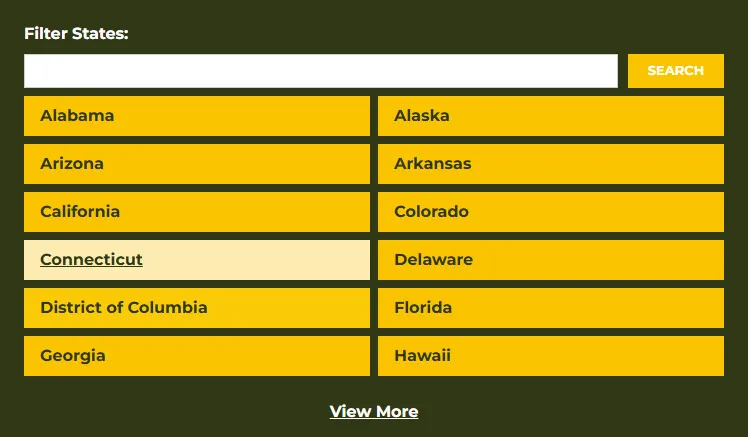

- Use a portal website

Another option is to use a public records portal website, like NETR Online. These portals act like a directory, organizing links to various government offices and record databases across different states and counties.

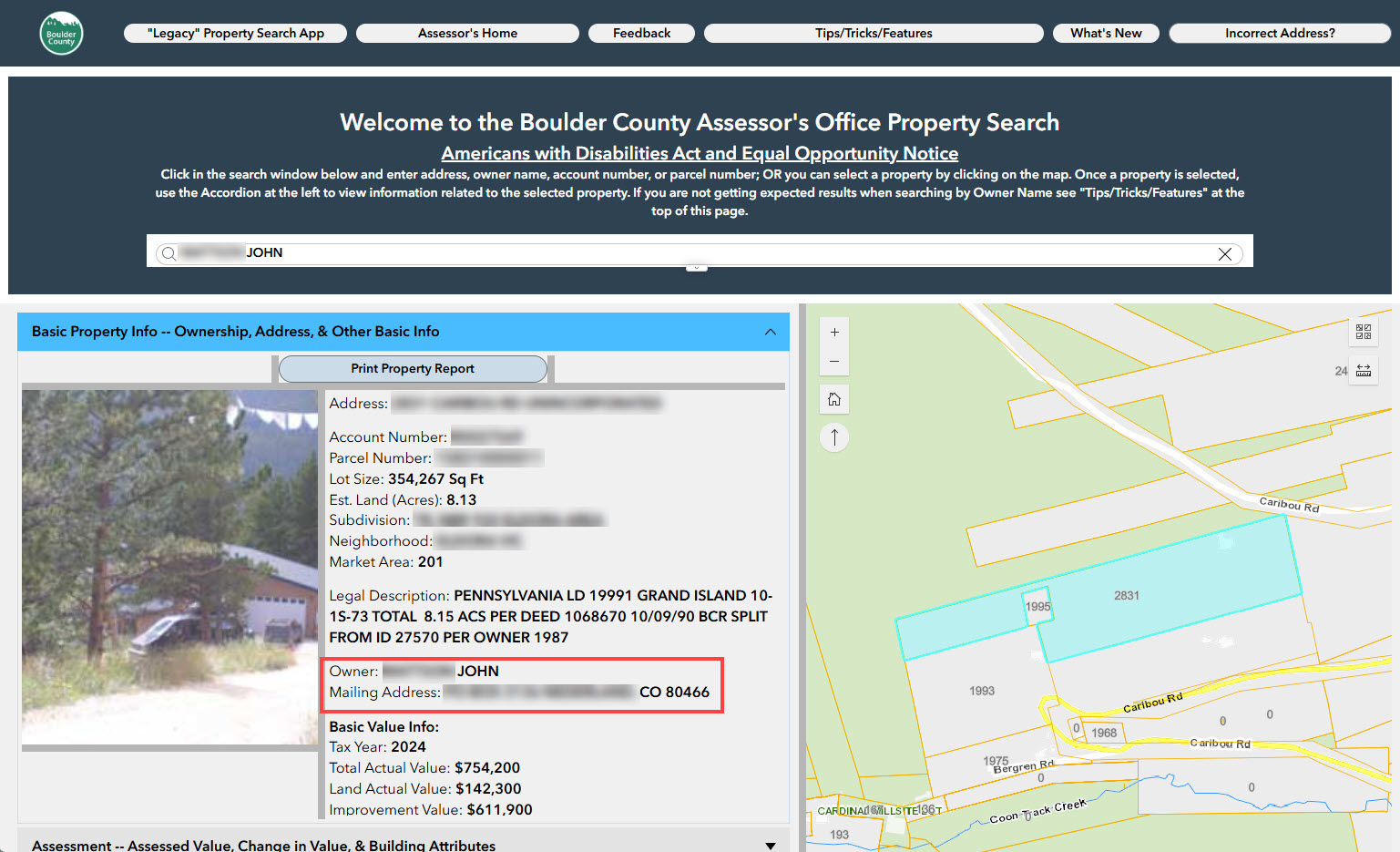

Check for properties: County Assessor’s Office

If someone has real estate in a specific county, you could find its record from the County Assessor’s Office. This does, of course, depend on knowing in which state and county their property is located.

- Go to the County Assessor’s Office page.

- Look for the link or button labeled “Property Search”, “Property Information”, or something similar. Here we take Boulder of Colorado as an example, and the exact wording might vary a bit depending on the county.

- You can then search by the person’s name (even a partial name works). The property details will show things like the mailing address, assessed value, sales history, and more.

It’s a good idea to search by the property address as well (if known). Sometimes, especially with commercial properties or investment holdings, ownership is held within a trust. This means the person’s name might not appear in the records, and searching by address helps you bypass this and find the property directly.

Check for businesses: County Clerk/Recorder & Secretary of State

Finding someone’s business assets often involves navigating both state and county records. State-level databases are ideal for researching large businesses such as corporations and LLCs. But for smaller enterprises, county records are the place to look into. So, your first step is to pinpoint the state and county where the person might operate businesses.

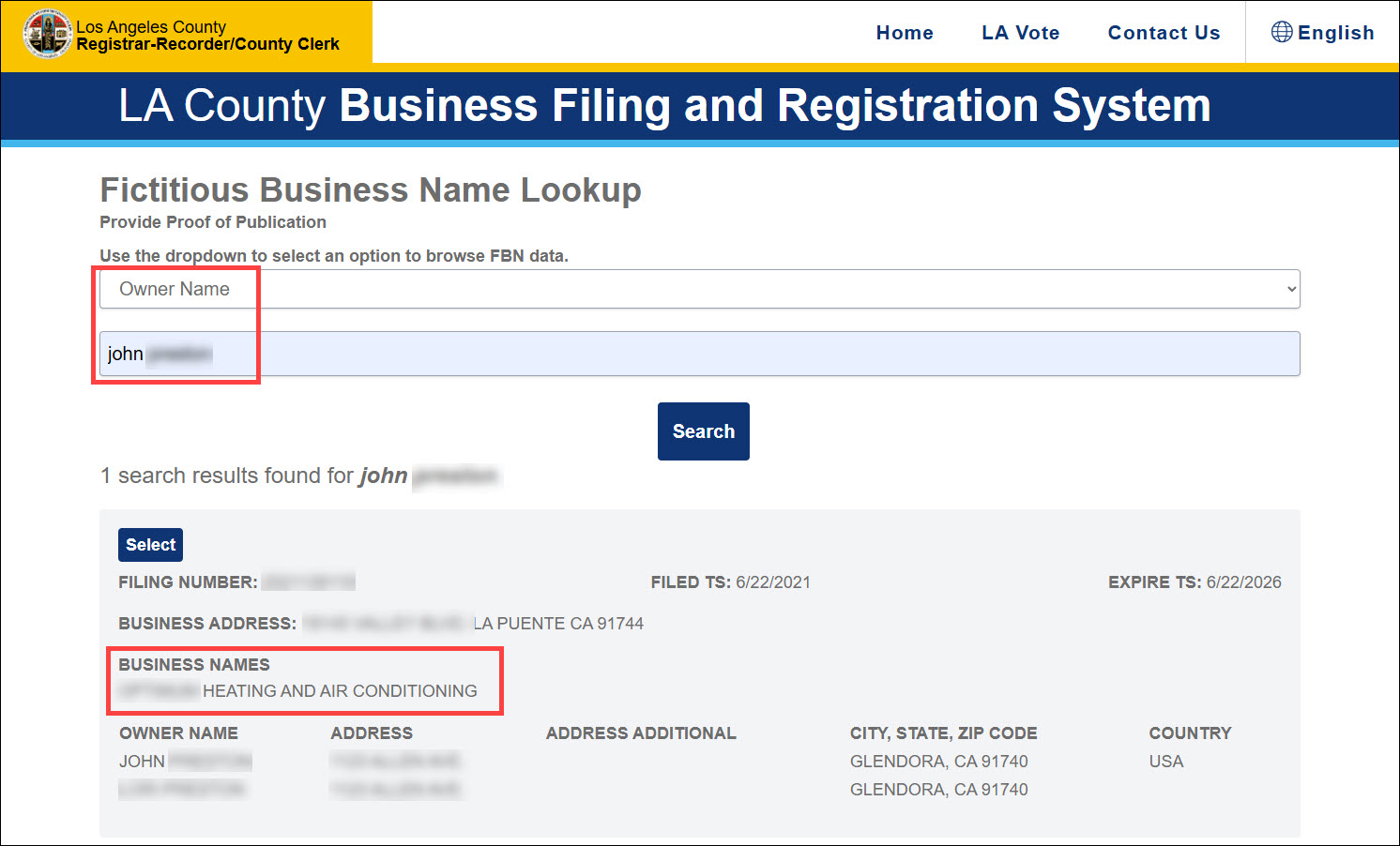

County-level searches

The County Clerk’s office handles registrations for DBAs (Doing Business As names), also known as fictitious business names. This is where someone like “John Smith” would register his bakery if he wanted to call it “Sunshine Sweets” instead of using his legal name.

Searching DBA records can reveal these connections, allowing you to find businesses linked to an individual even if they’re not operating under their legal name.

- Navigate to the County Clerk/Recorder page. We use Los Angeles County as an example here.

- Look for entries labeled as “Fictitious Business Names” or “Doing Business As”, and click on the search button.

- Enter the person’s name to start the search process. If it locates a match, you’ll see the name, address, and some related details of the business.

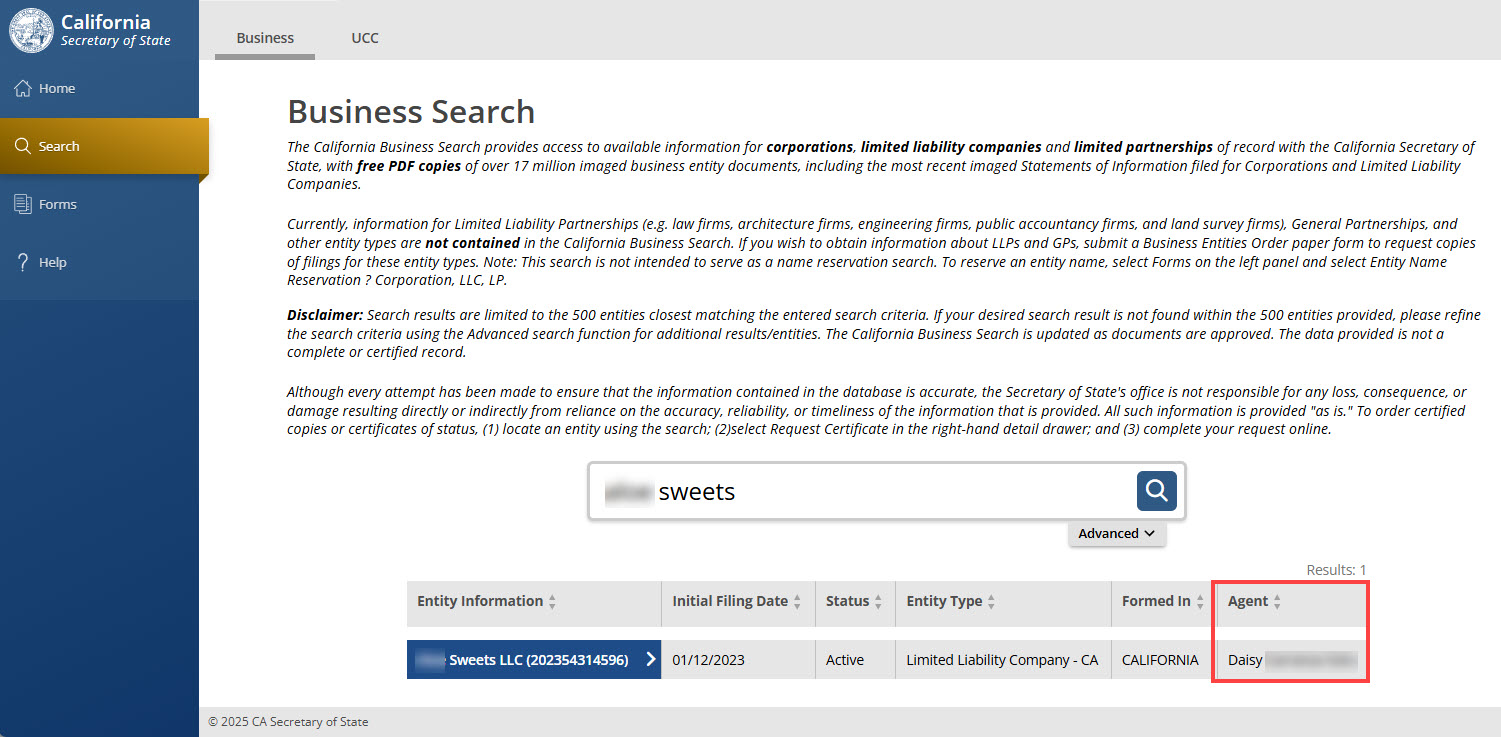

State-level searches

At the state level, the Secretary of State’s Office is the go-to resource for details about a business’s legal structure and official standing. However, searches here are typically conducted by business name, not an individual’s name. So, it’s most effective when you already have a general idea of the business name and want to verify its status or learn more about its details.

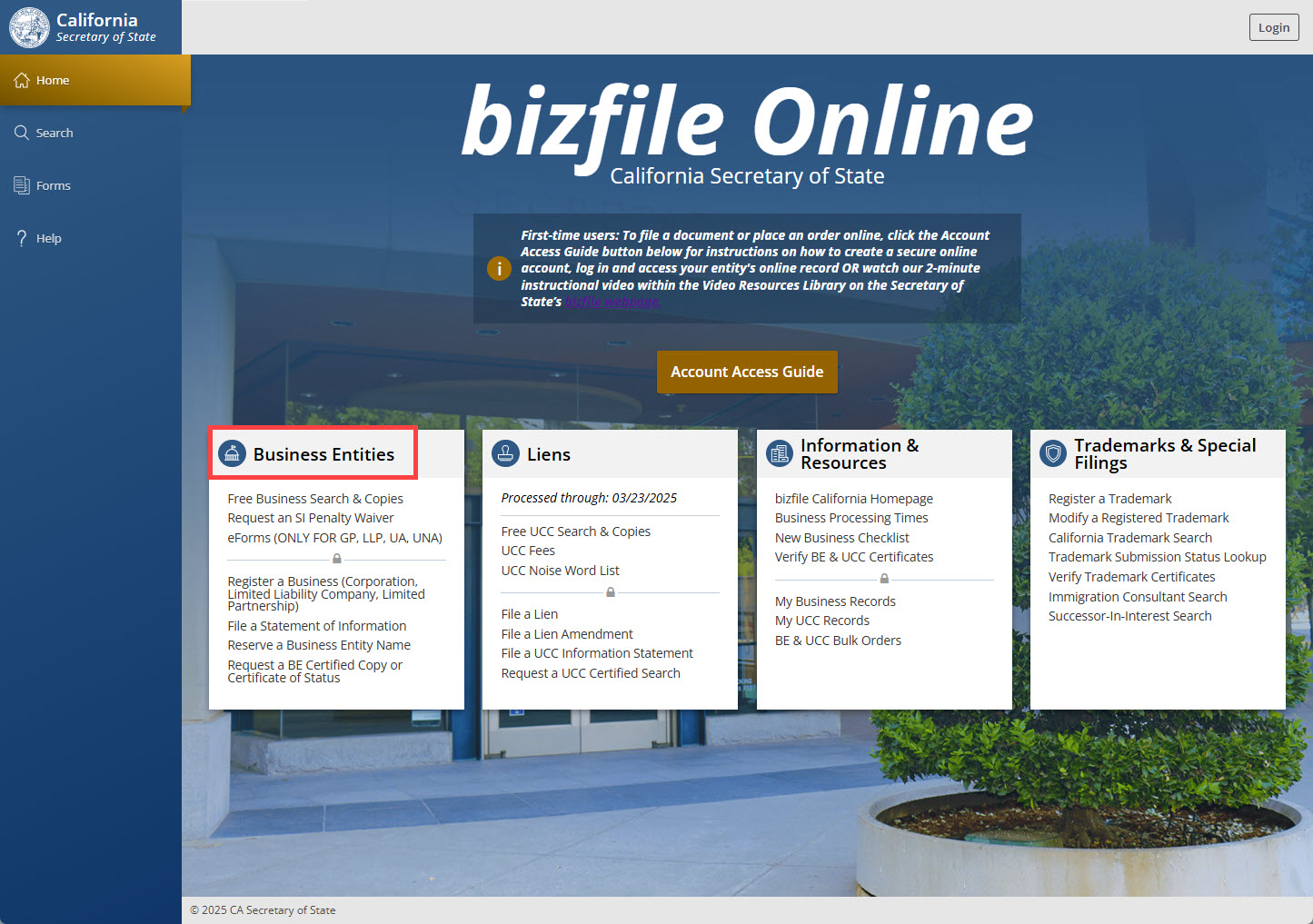

- Go to the Secretary of State’s Office page and look for search entries like “Business Entities” or “Trademarks”. For example, California names its portal “bizfile Online”.

- Click on the business search button and enter the name of the business. You’ll get to know the agent, address, and other information if there’s a match.

You should note that a registered agent is simply the designated recipient of legal and official documents for the company, not necessarily the owner. But, identifying the registered agent can still offer valuable clues about a person’s business affiliations.

Check for vehicles: Third-party search tools

Finding out if someone owns a vehicle isn’t easy. DMVs (Department of Motor Vehicles) and other government agencies generally keep vehicle ownership information confidential, mainly to protect individual privacy. The only exception is during a lien sale process, where a court judgment allows the sale of a vehicle to satisfy a debt. So, you won’t be able to simply look up someone’s name and see a list of their vehicles from official sources.

That being said, some third-party websites, like public record search sites, might offer this information. Because they compile and cross-reference data from a wide network of public sources and sometimes manage to connect individuals to vehicle ownership (learn more). Although it’s not a sure thing, it’s still worth exploring.

Other sources that might be helpful

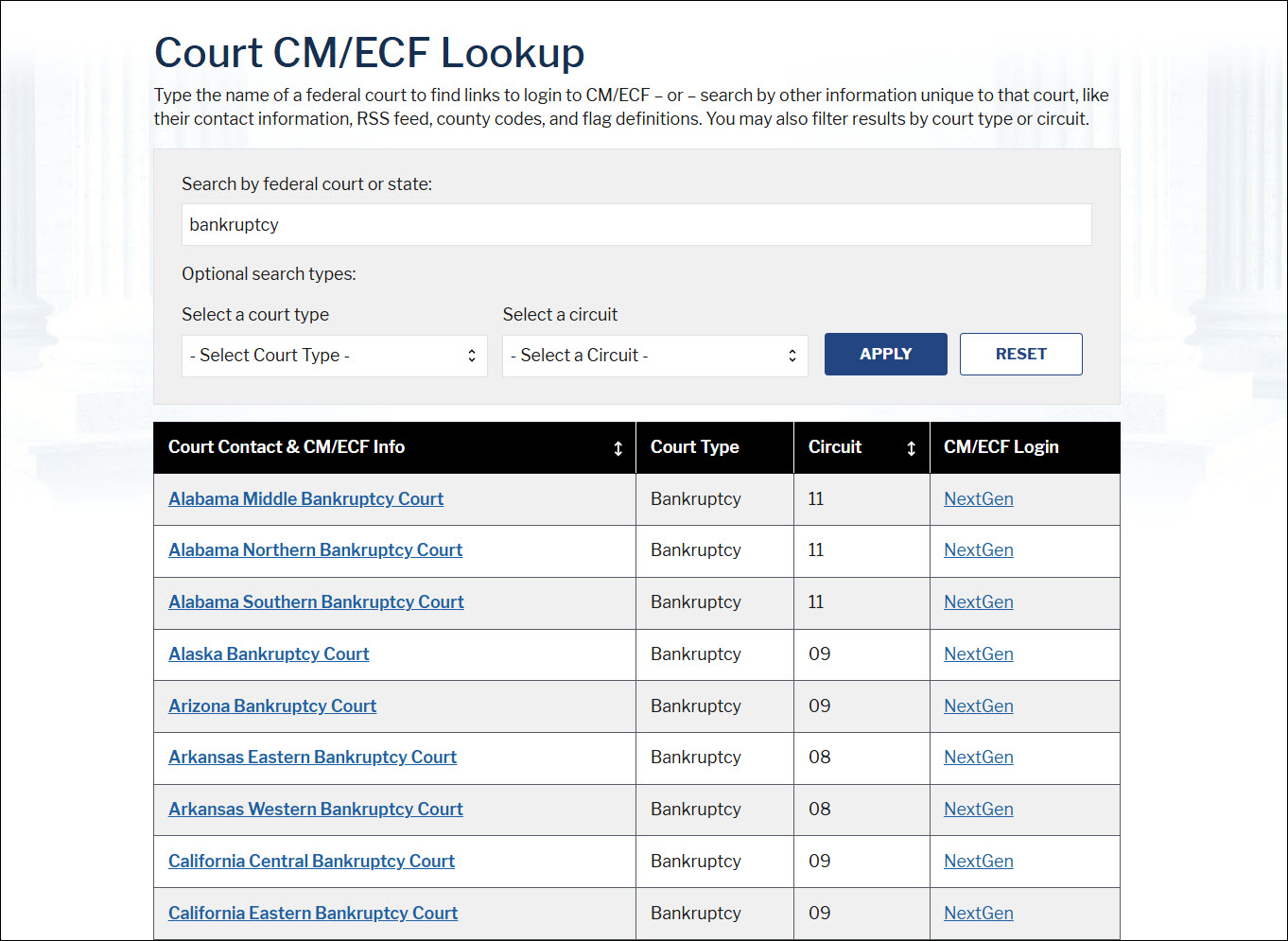

PACER

PACER (Public Access to Court Electronic Records) is an online system that provides access to federal court records, including bankruptcy filings. You can use it to check if someone has filed for bankruptcy.

- To get started, you’ll need to create a PACER account with your personal info like name, address, DOB (date of birth), email, and phone number.

- Use its case locator to navigate to the target bankruptcy court and search by the person’s name.

- If the person has filed for bankruptcy, you’ll see the court record there, including the filing date, the type of bankruptcy, and other related documents. Be aware that there’s a small fee per page viewed, and that’s why you’ll need to provide your credit card information upon registration. You can check this page for options to get PACER records free of charge.

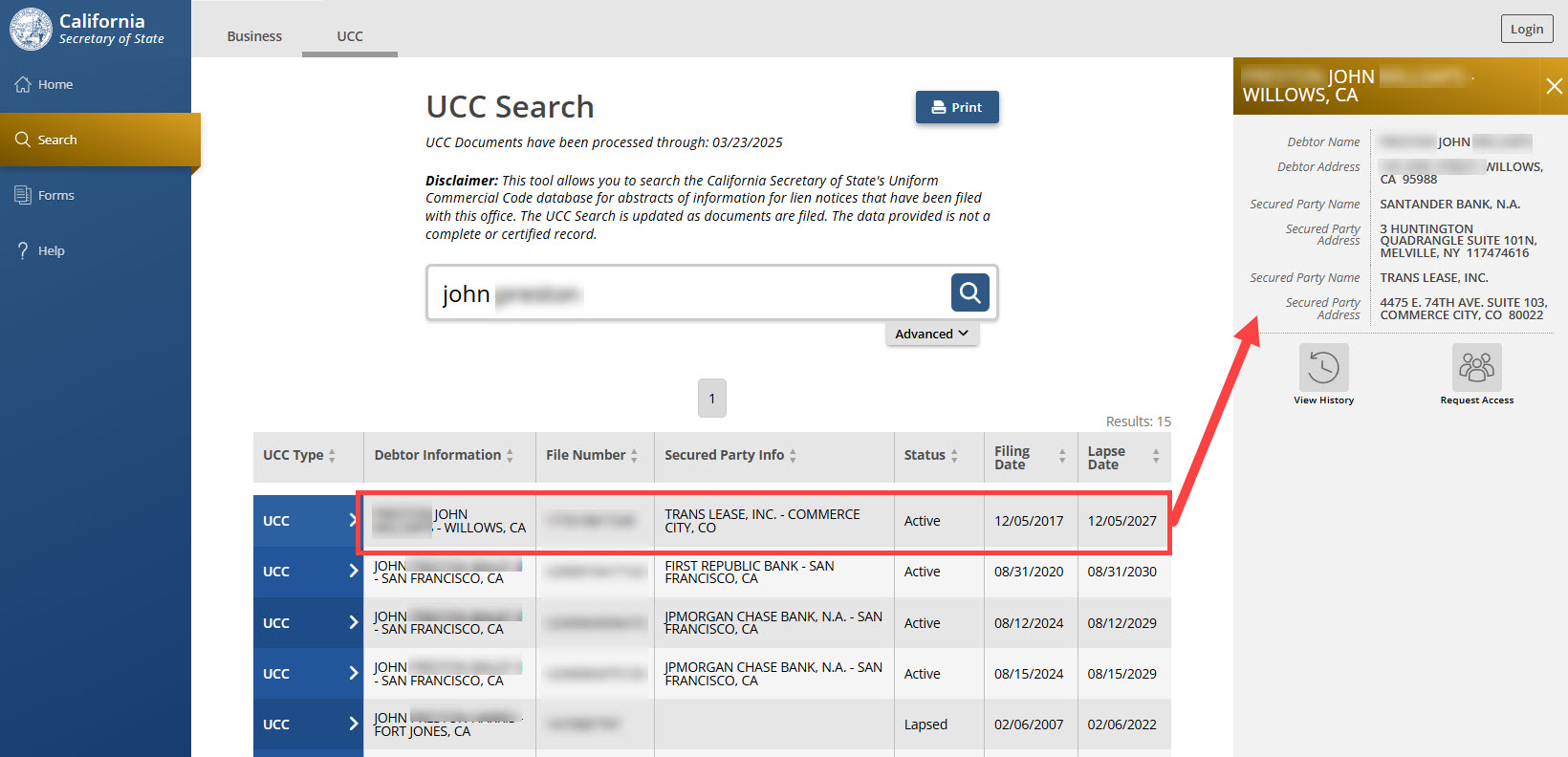

UCC search

You can find out if someone has used their assets as collateral for a loan by searching the UCC (Uniform Commercial Code) filings. When someone borrows money and pledges an asset as security, like equipment, inventory, or even vehicles, the lender typically files a UCC lien to make their claim public.

- To search, you’ll first need to access your state’s UCC filing system, which is often available through the Secretary of State’s office page. Or you can simply search for “UCC search [state]” on search engines to find the entry.

- Once on the page, you can search by the person’s name. Here we take California as an example.

- If you find a UCC filing, it means they’ve likely used an asset to secure a loan.

A quick reminder would be that a UCC search only tells you debts secured by specific assets. It doesn’t show unsecured debts like credit cards or medical bills, so it doesn’t provide a complete picture of someone’s total debt.

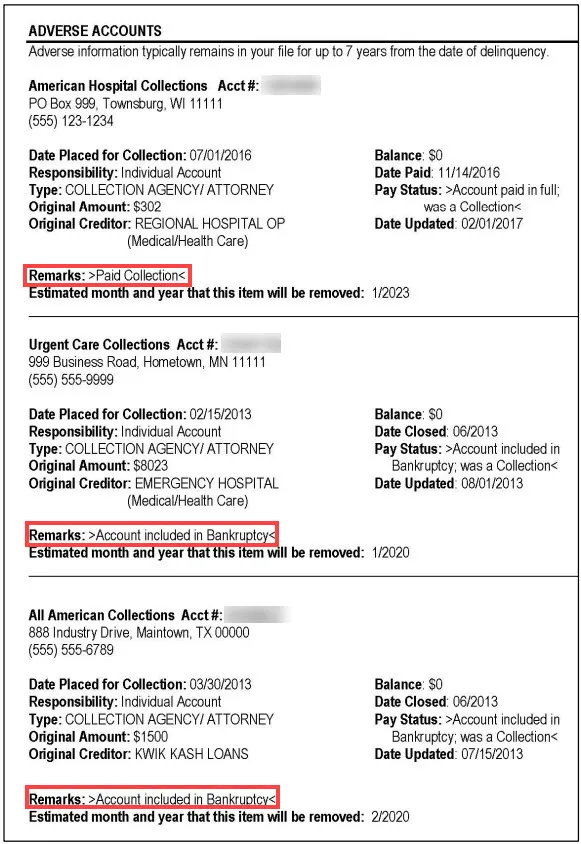

Credit report

A credit report doesn’t directly list assets like bank accounts or investment portfolios, but some details might indirectly suggest certain financial aspects.

For example, large loans or mortgages might suggest the individual possesses significant assets to secure the financing. Similarly, high credit limits on credit cards can sometimes indicate a substantial income or net worth. The presence of multiple accounts with different creditors could point to a complex financial profile, potentially including various asset holdings.

However, it’s crucial to remember that these are just potential inferences, not definitive proof of assets. More importantly, accessing someone’s credit report without a legal reason under the Fair Credit Reporting Act and without their consent is illegal. So we recommend you consider other options first.

2. Use a public record search tool

| Best when: You’d prefer a quick overview of their asset-related information. Maybe you don’t want to spend too much time, or you just don’t know them well enough to conduct a deep dive. |

Searching for someone’s assets manually can be time-consuming, you might wonder if there’s a platform that could show you everything in one place. The truth is, no tool can give you all of someone’s assets – some information is simply private. But public record search tools can help speed up the process of searching for publicly available information.

These tools work like a central hub for public records, pulling together information from various sources, including state and local government records, webpages, social media, and even some exclusive databases that might be hard to find on your own.

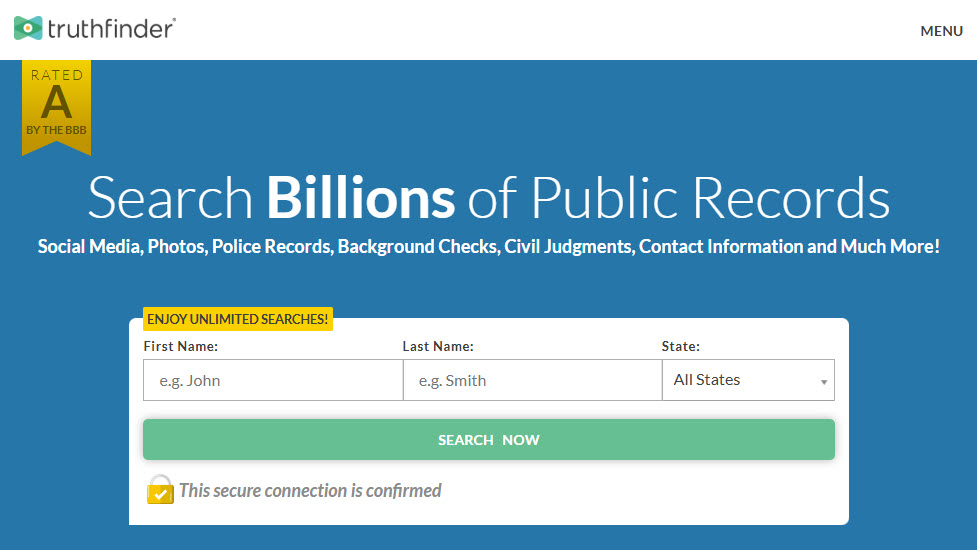

After testing several popular choices, we found TruthFinder can generate the most informative reports within minutes, covering details like:

- Properties, Vehicles (with VIN), Businesses, Bankruptcies, Liens, and Licenses.

Besides assets-related information, it can also provide the person’s:

- Contact info (phone numbers and email addresses), Address history, Social media pages, and Criminal and traffic records.

How to get started with TruthFinder

- Go to TruthFinder, enter the person’s name, select the state they’re in, and click on the search button.

- Give TruthFinder a few moments to complete the search. You’ll then see a list of possible matches, and you might need to click through a few screens to confirm some details along the way.

- To view the full report, you’ll need to create an account using your name and email address and choose a subscription plan (around $28/mo).

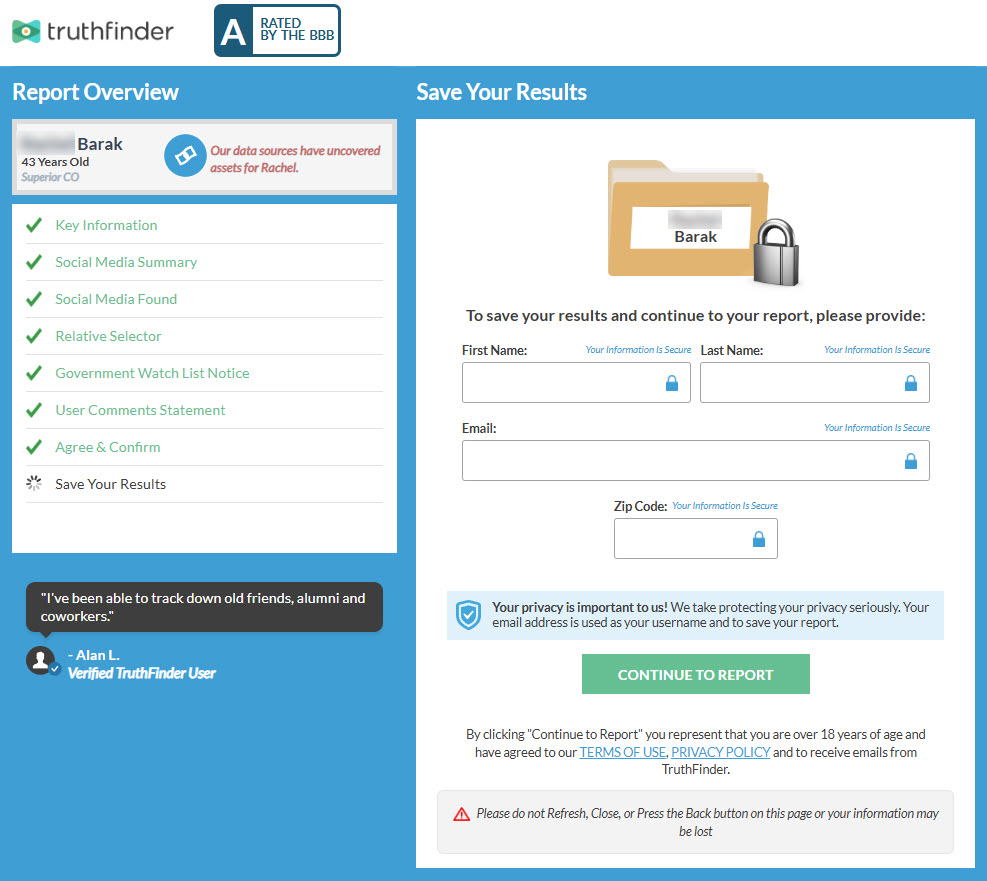

Your report at a glance

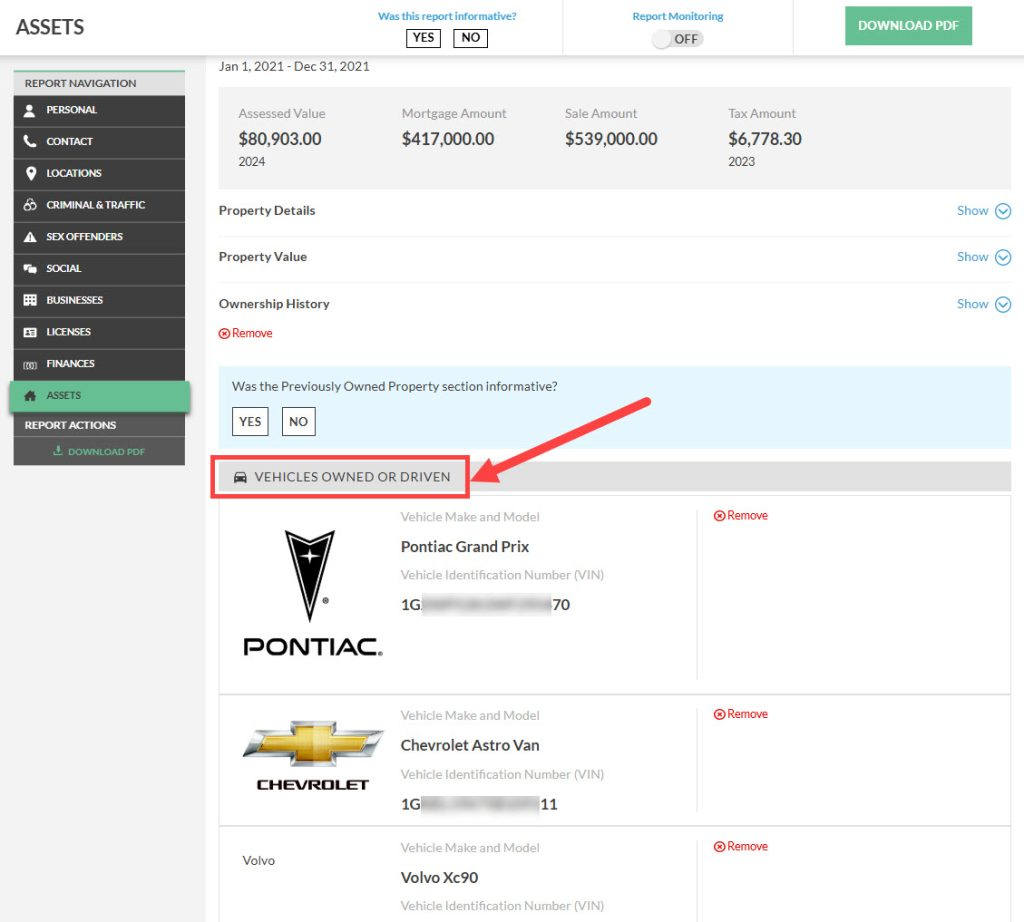

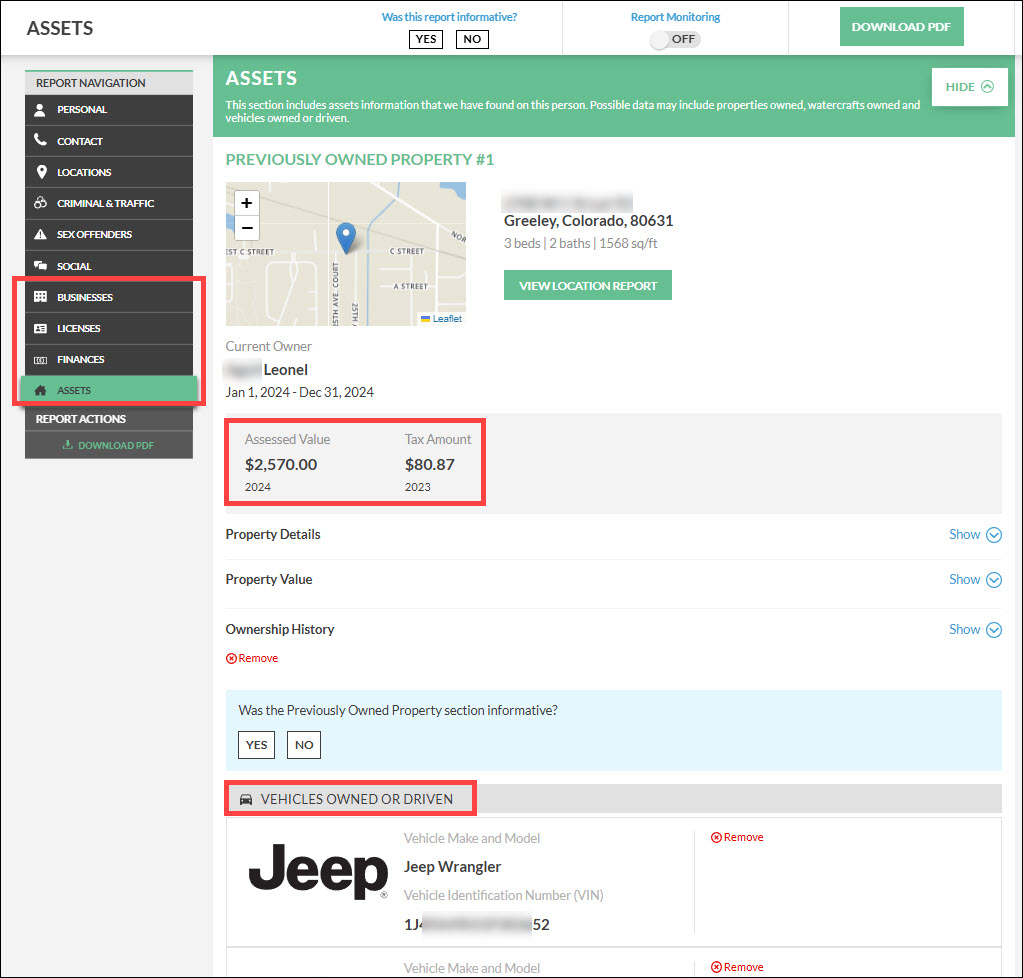

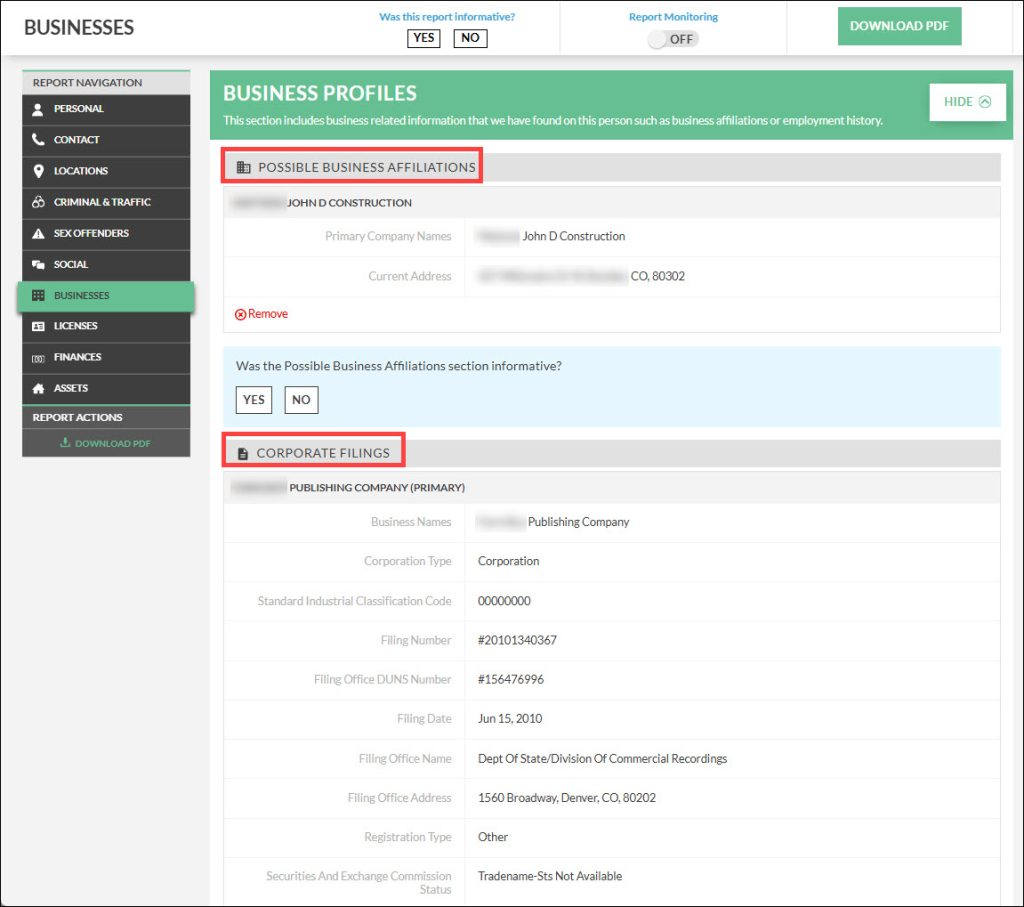

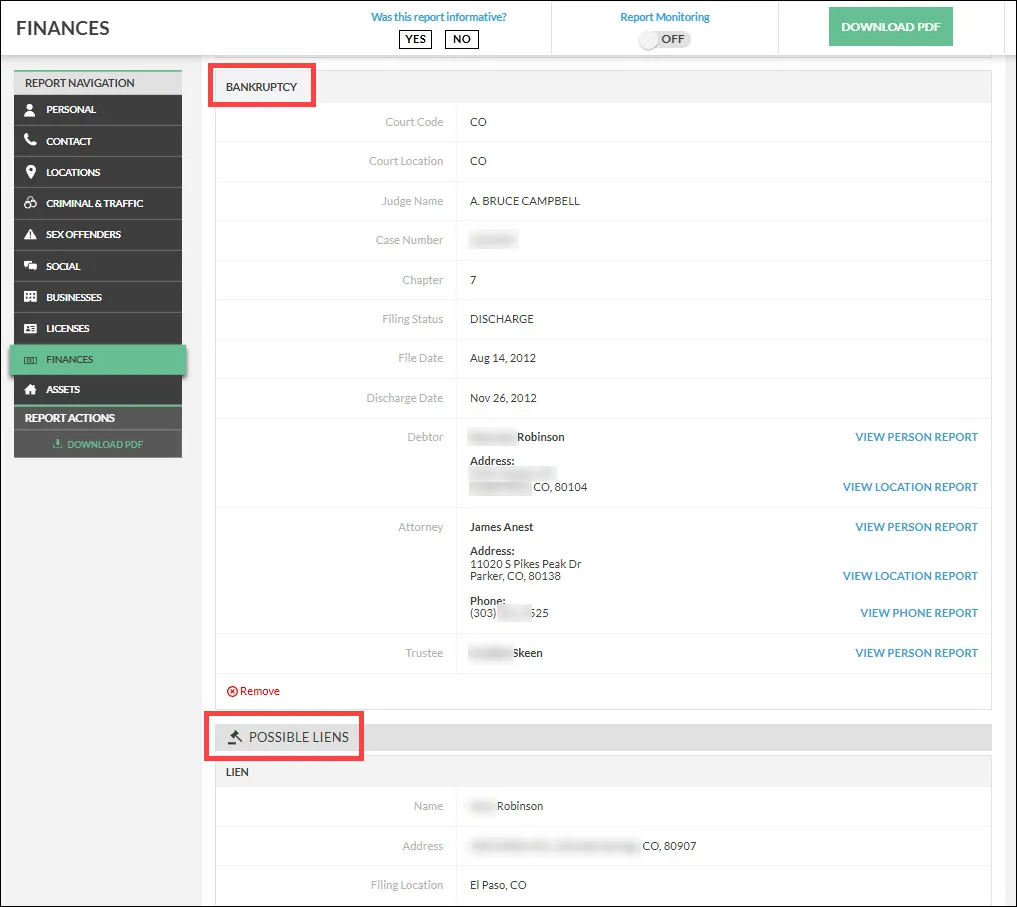

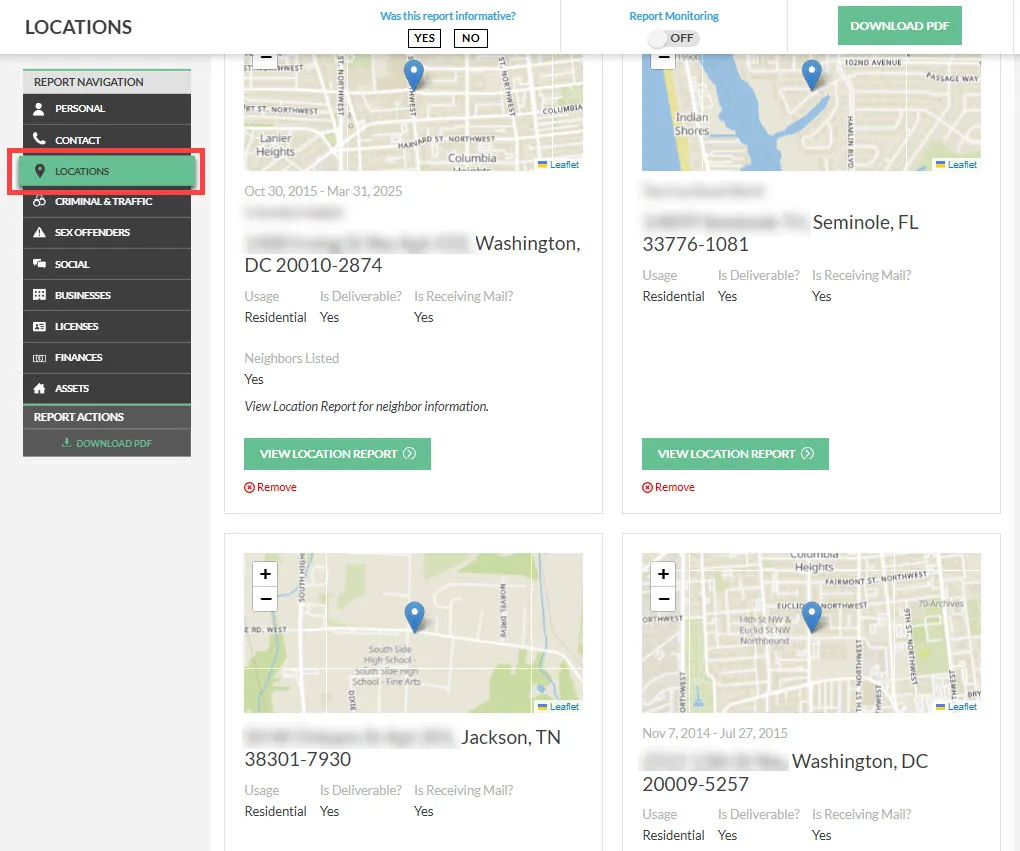

The report you get will have a navigation bar on the left side to help you find what you need. To find asset details, look under sections like ASSETS, BUSINESSES, and FINANCES.

Assets

You might find the properties owned or previously owned by the person, their vehicles with VINs, and an estimated value.

Businesses

It might show possible business affiliations, corporate filings, and some more details related to the person. Sometimes it includes the companies that the person has worked for, so you might need to filter them out.

Finances

You might get a quick look at the person’s possible bankruptcy filings and liens, which can help you get a more comprehensive idea of their financial situation.

Address history

The report might list the person’s previous addresses, suggesting potential assets in those states. That’s definitely worth investigating further.

A few facts about public record search tools

- Are they worth the money?

It actually depends on your needs. Indeed, you can find the same public information scattered across various government websites for free. But these tools can collect information across multiple counties or states, saving you much time and effort. Besides, some official records, like court documents, often require fees to access, even if you do the legwork yourself. Beyond asset information, these tools can also provide other helpful details. So they’re ideal if you need a quick and one-stop solution.

- Do they offer 100% accurate reports?

You should know that no tool is perfect. Public records themselves can contain errors, and these tools are simply aggregators, not the original source of the information. So, while they can be a good helper, it’s crucial to double-check things you get.

3. Find clues from their social media profiles

| Best when: You’ve connected with this person online and are curious to learn more about them through their social media presence. |

Social media can tell you a lot about a person, even offering hints about their finances. Take LinkedIn, for example. A quick look at someone’s profile can provide insights into their career path, including their current and past roles, promotions, and any board memberships. These details can give you a sense of their potential income level and accumulated wealth.

Besides, their publicly available posts and comments on other platforms might mention significant purchases, investments, or business ventures, offering further hints about their assets. For example, mentions of luxury travel, high-end hobbies, or charitable giving can suggest a certain level of affluence.

Keep in mind, though, social media is a highlight reel, not the whole story. People tend to showcase their wins and downplay any financial difficulties. If you’re vetting potential dates, a profile that seems too perfect might even be a red flag. So, while social media can offer clues, don’t take it as definite truth. It’s important to consider other sources and methods for a more complete picture.

How to find out the average pay for a specific job?

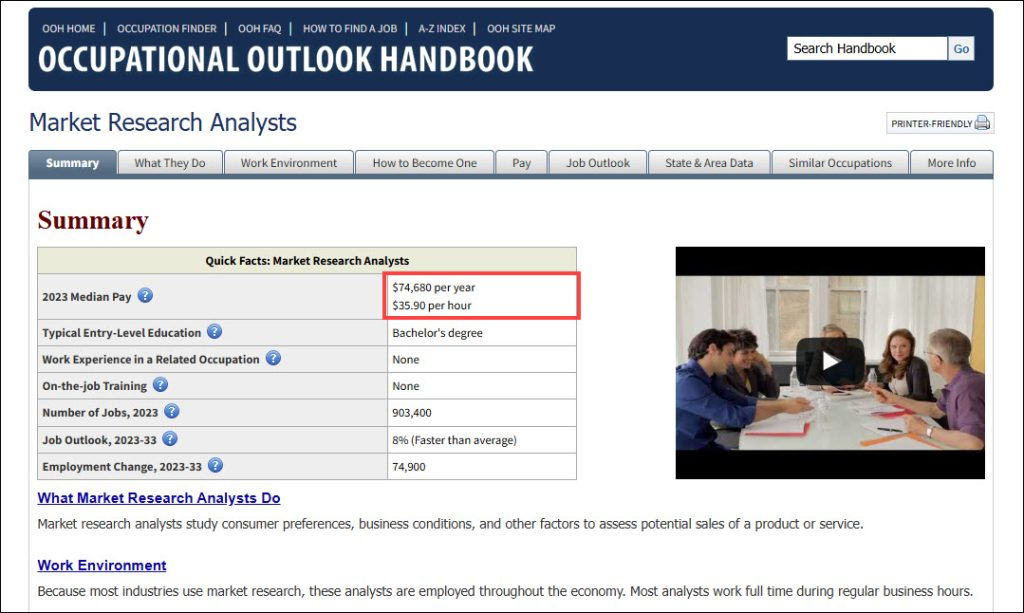

Once you have an idea of someone’s profession, you’ll probably want to get a sense of the salary. One user helpfully pointed out the BLS (Bureau of Labor Statistics) website, a great resource for US wage data[1].

Just search for the job title, and you’ll find data like the median pay, typical education level required, and even future job prospects.

You can even drill down to see how salaries vary by state by clicking on the “State & Area Data” link. This gives you a much better idea of potential earnings based on location.

4. Seek professional help

| Best when: You’re dealing with a difficult situation, such as a financial dispute, that has become too much to handle. |

If you’re struggling to resolve a financial dispute, especially after exhausting your own search efforts, it might be time to bring in the professionals. This could mean hiring a private investigator to conduct more targeted asset searches, and even consulting a lawyer who can provide expert legal guidance and handle the necessary paperwork, including appeals if required.

The good thing about going the legal route is the court’s power to do things you simply can’t do yourself. This can be a game-changer in uncovering hidden assets and getting back what you’re owed. Through court orders, you could compel the disclosure of financial information and even seize assets to satisfy a judgment. Legal procedures can be expensive, so it’s necessary to find good, licensed professionals with a solid reputation.

How to find someone’s assets after they passed away?

Dealing with a loved one’s estate after they’re gone is tough, especially the part where you have to figure out everything they owned. It can feel like a huge task, from finding bank accounts and property deeds to even remembering their online logins. Follow these essential steps to locate and organize their assets.

1. Identify who’s the estate executor/administrator

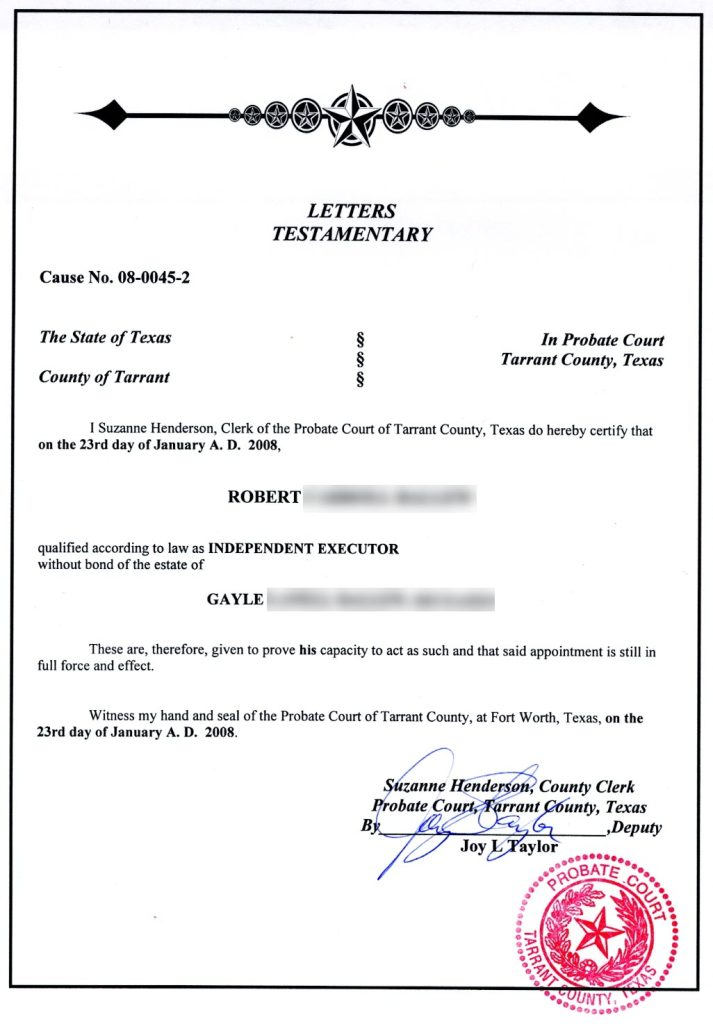

When someone passes away, their assets usually have to go through a legal process called probate[2]. The probate court first checks if there’s a valid will and if someone’s named to handle things, which is called the executor. If there’s an executor, the court gives them official permission with a document called Letters Testamentary (or Letters of Executorship). But if there’s no will or no executor named, the court steps in and appoints an administrator based on state laws.

Just so you know, only the executor or administrator (sometimes called the personal representative) can legally handle the deceased‘s assets. Once they’re officially appointed, they can start taking care of everything.

2. Key places to look for asset information

To save time and effort, it’s best to gather some important information upfront before searching. This includes the person’s date of birth and death, social security number, death certificate, court paperwork, and any other relevant personal details. Here’s where to start:

Personal files

Begin your search by thoroughly examining the deceased’s personal files. Look in likely locations such as filing cabinets, desk drawers, and safe deposit boxes. Key documents to look for include bank statements (checking, savings, money market), investment account statements, property deeds, titles to vehicles, tax returns (federal and state), pay stubs, and the driver’s license.

These documents often contain account numbers, contact information for financial institutions, and other crucial details about assets.

Financial institutions

Once you’ve gathered information from personal documents, contact all identified banks, brokerage firms, investment companies, credit unions, and other financial institutions. Provide them with the deceased’s account numbers if known, along with supporting documentation such as a copy of the death certificate and proof of your authority as executor or administrator. Inquire about all types of accounts, including checking, savings, IRAs, 401(k)s, and loan documents.

Public records

Use online resources to search public records. Many state and county government websites offer access to property records, business registrations, court filings (including bankruptcy records, probate cases, and liens), and other valuable information that can uncover asset information.

Life insurance

Determine if the deceased had any life insurance policies by using the free Life Insurance Policy Locator provided by the National Association of Insurance Commissioners (NAIC). This service can help locate policies from participating insurance companies. Additionally, check the deceased’s employment records for information on group life insurance benefits.

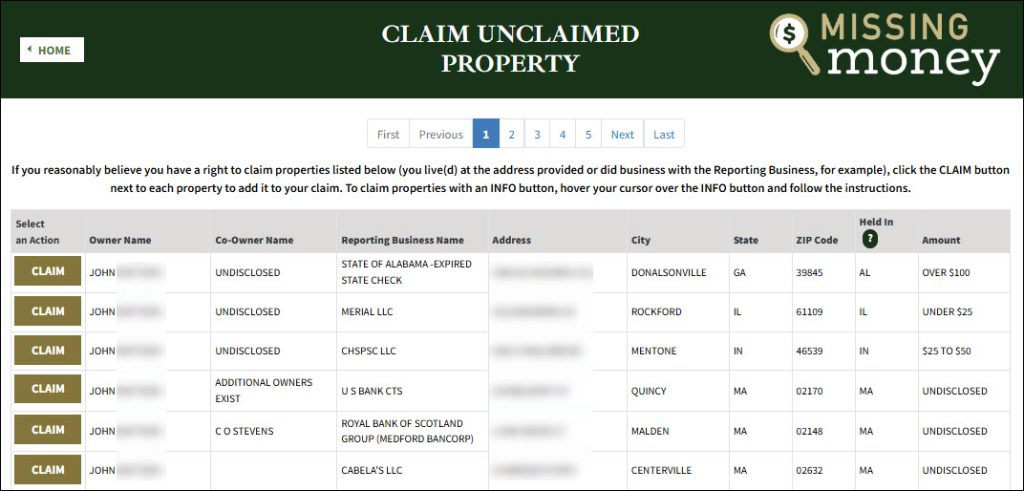

Unclaimed properties

Sometimes assets just slip through the cracks and end up unclaimed. A platform for finding these is MissingMoney.com, a national database of unclaimed property turned over to the state when financial institutions can’t locate the owner. Search each state they lived in, as state laws vary on how long before an inactive account is turned over to the state. So it’s a good idea to check back periodically as new properties are reported regularly.

Online accounts

Online accounts are often overlooked when handling an estate, yet they can contain vital information, memories, and even assets.

A good first step is accessing the person’s phone and email, as many online services are linked to them. It’s often the easiest way to access everything. Although some companies will grant access to the deceased’s accounts with the right documentation, others, like Google, have stricter rules and might only allow account closure or limited access to content. As shared on forums, regaining access to a Google account can take up to 6 weeks[3]. That’s why getting into the phone and email is so crucial.

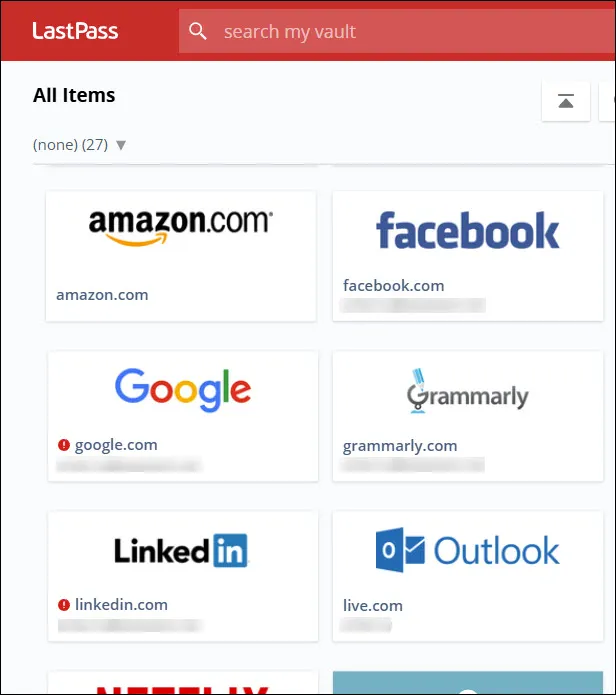

Also, check for password managers. These can be built into web browsers or standalone extensions like LastPass or 1Password. Password managers offer a centralized list of login credentials, giving you a glimpse into the different platforms the person used and potentially revealing important accounts like banking and financial services.

There are definitely a few different ways to find someone’s assets. Combining a few of these methods usually gives you the best results. Of course, respecting privacy is key here. And remember, for a more accurate view of their finances, you need to look at both sides of the coin: what they own and what they owe (loans, mortgages, etc.). That’s how you get their net worth, which is a much better indicator of their financial health than just looking at what they own.

*All product names, logos, brands, trademarks and registered trademarks are property of their respective owners.

TruthFinder does not provide consumer reports and they are not consumer reporting agencies as defined by the Fair Credit Reporting Act (FCRA). It must not be used to determine an individual’s eligibility for credit, insurance, employment, housing or any other purpose covered by the FCRA.

- r/recruitinghell [BoboSway]. (2022, February 21). Super Easy Way To Find Out Average Pay For Any Job (U.S Only). [Online forum post]. Reddit. https://www.reddit.com/r/recruitinghell/comments/sxfcge/super_easy_way_to_find_out_average_pay_for_any/↩

- California Courts Self-Help Guide. (n.d.). Guide to property after someone dies. https://selfhelp.courts.ca.gov/probate↩

- Google Account Help [JC McDonald]. (2023, September 4). Recovering A Deceased’s Account. [Online forum post]. Google. https://support.google.com/accounts/thread/233319032/recovering-a-deceased-s-account?hl=en↩

View all of Arlee Hu's posts.

View all of Arlee Hu's posts.